Copyright View the Space, Inc. 2026

METHODOLOGY

VTS Office

Demand Index

(VODI)

Quarterly Report

Get a pulse on what’s happening in the market today.

Explore nationwide trends

Annual gains still going despite year end deceleration

NATIONAL

KEY TAKEAWAYS

NATIONAL TRENDS

LOCAL TRENDS

METHODOLOGY

COMPANY

National

Local

KEY TAKEAWAYS FROM THIS REPORT

NEXT

VTS Office

Demand Index

(VODI)

QUARTERLY REPORT

January 2026

The VODI softened in Q1 2025. Although the index ended the quarter at 68—up a modest 4.6% from a year earlier—that figure masks declines in January and February that ended a 20-month streak of year-over-year growth.

NATIONAL

The first quarter of 2025, however, showed uneven movement:

LOCAL

Get a pulse on what’s happening in the market today.

Copyright View the Space, Inc. 2025

BACK TO TOP

METHODOLOGY

National

Local

KEY TAKEAWAYS FROM THIS REPORT

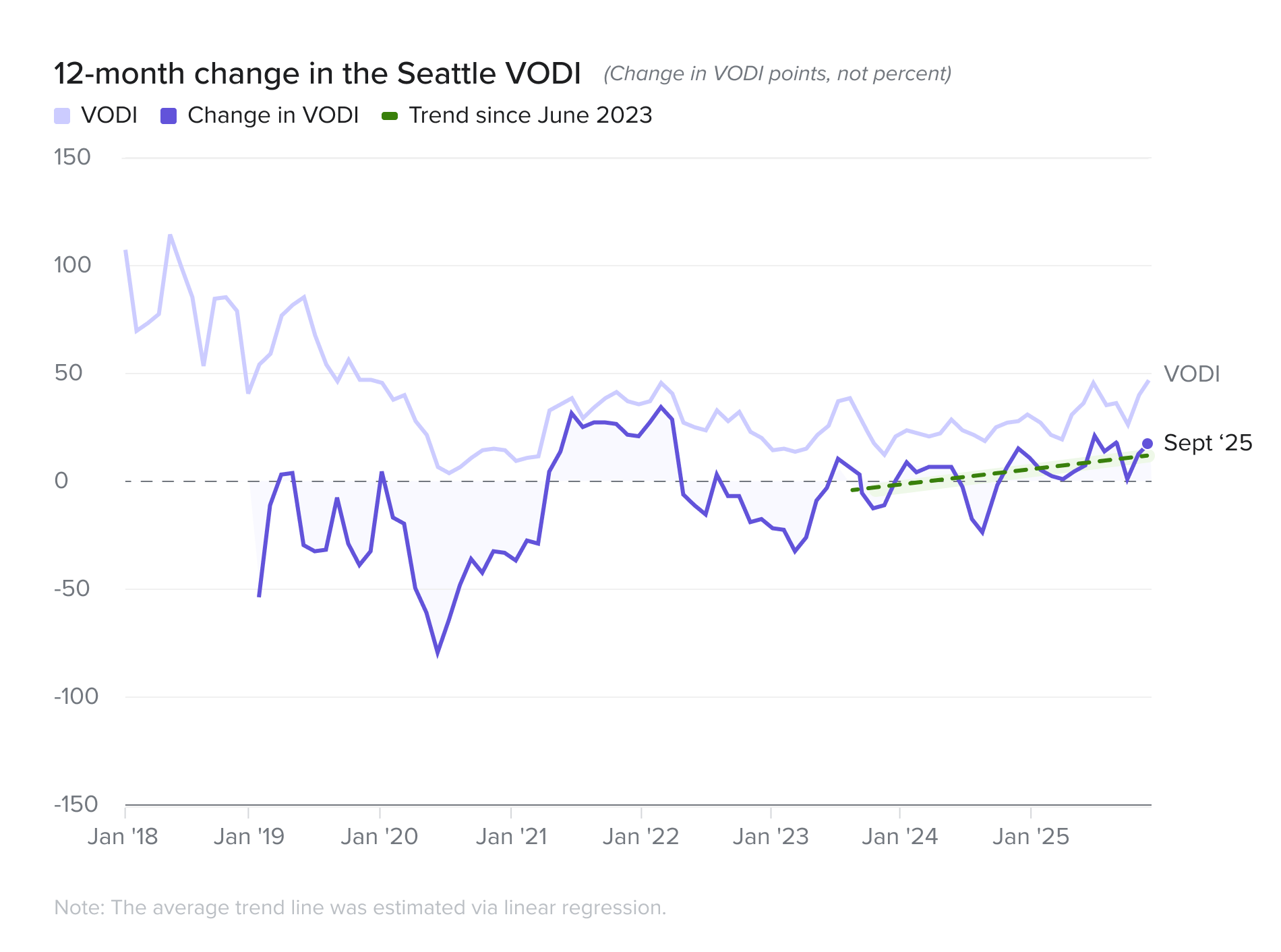

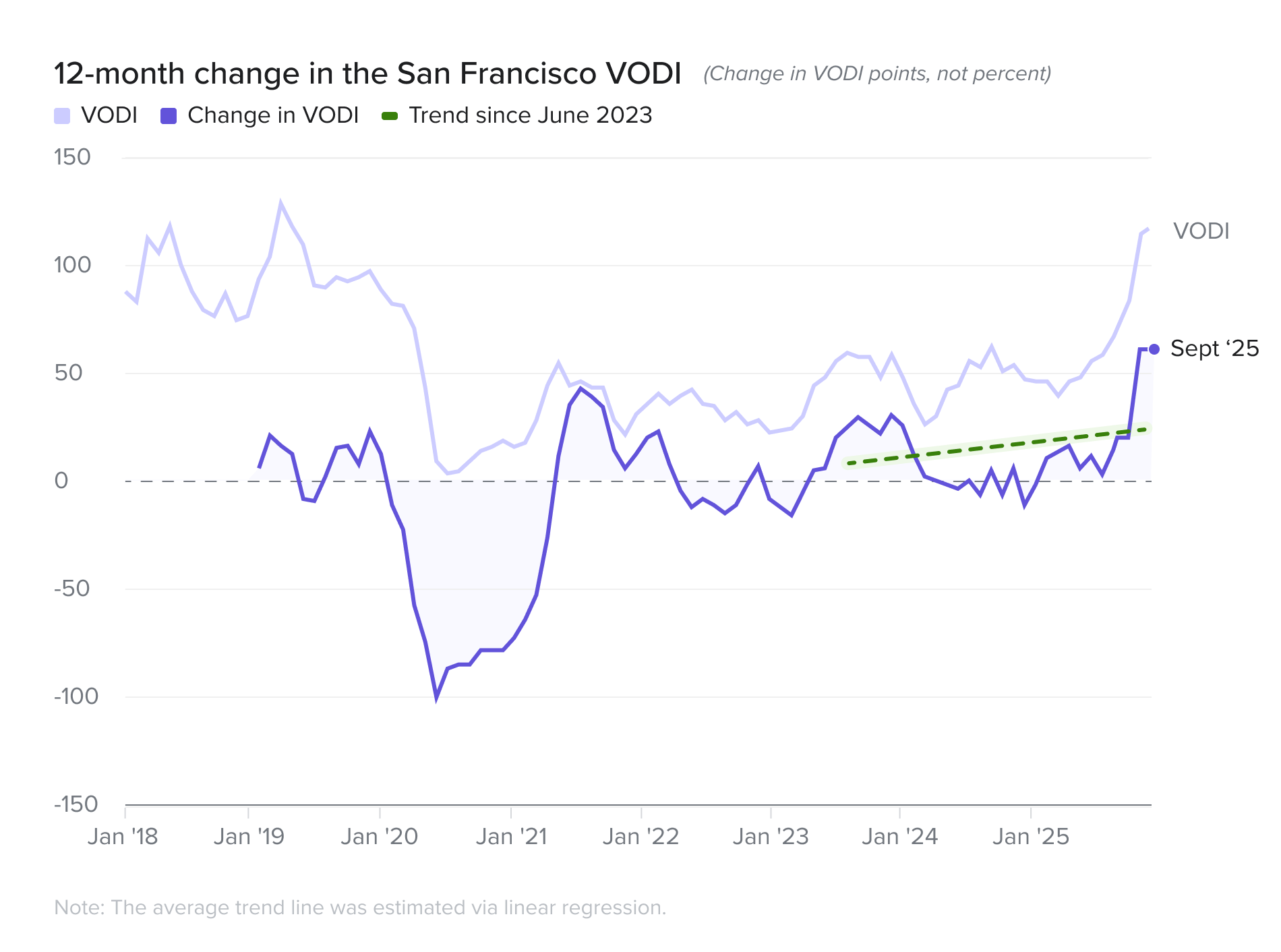

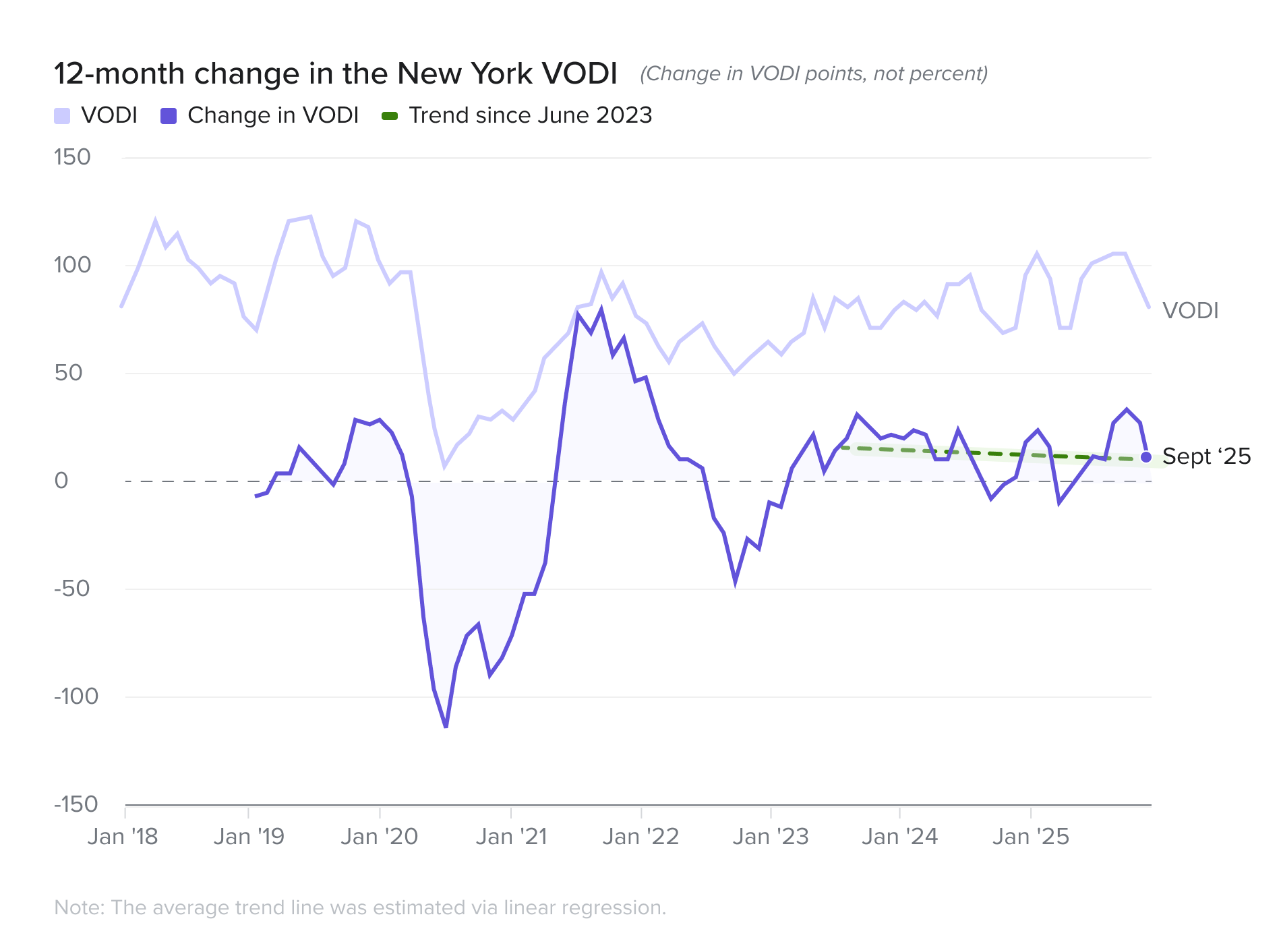

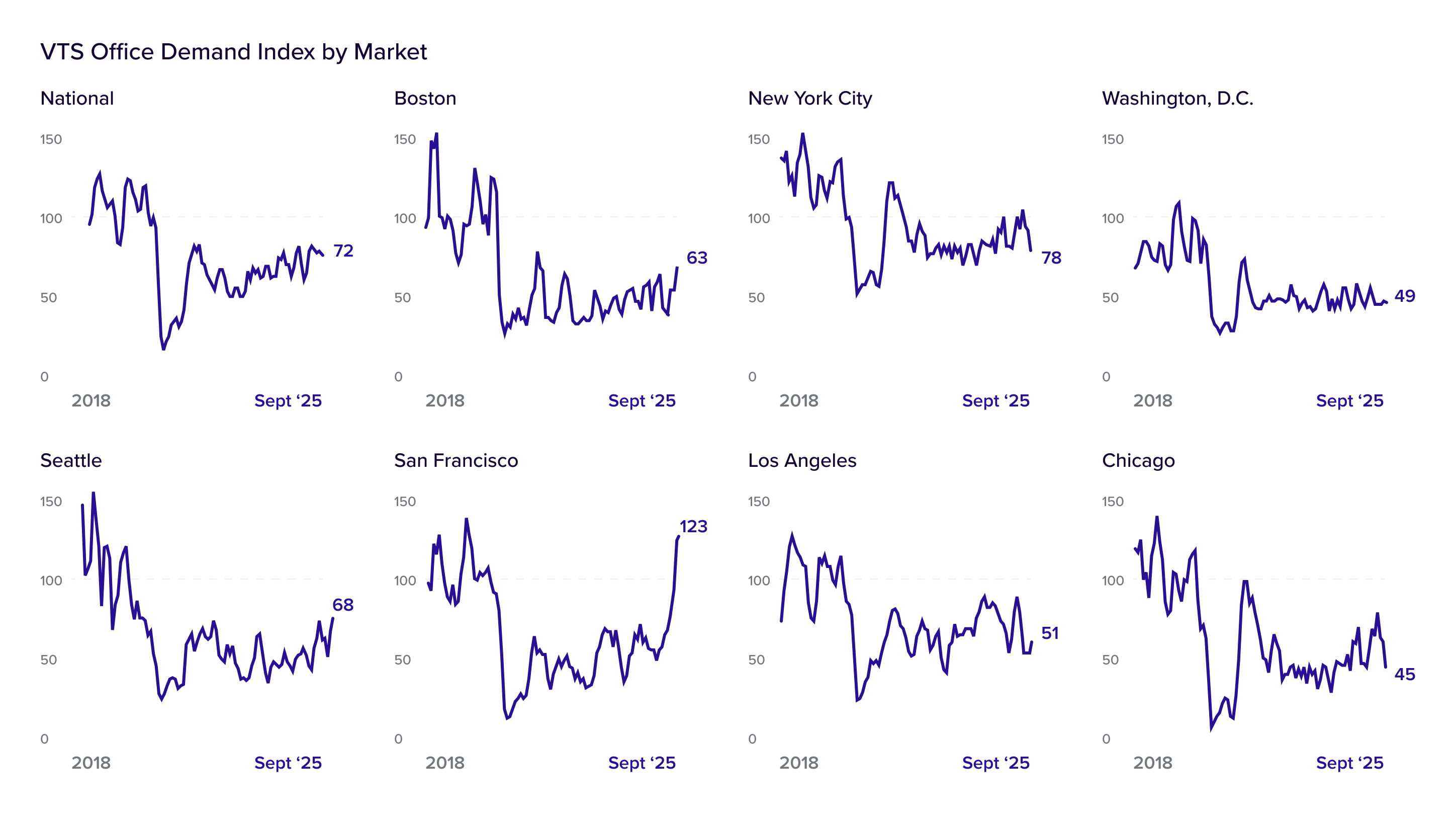

The Tech Leaders: Tech demand was the year’s defining factor for distinguishing clear leaders from the rest. San Francisco and Seattle both finished 2025 with a dominant near 50 percent year-over-year increase in their VODI figures, directly tied to the tech surge witnessed nationally. Markets like Chicago and Washington, D.C., which have seen inconsistent gains from their core sectors had VODIs driven higher from the uptick in tech demand. New York held steady quarter-over-quarter, with robust tech demand helping balance softer performance from other industries.

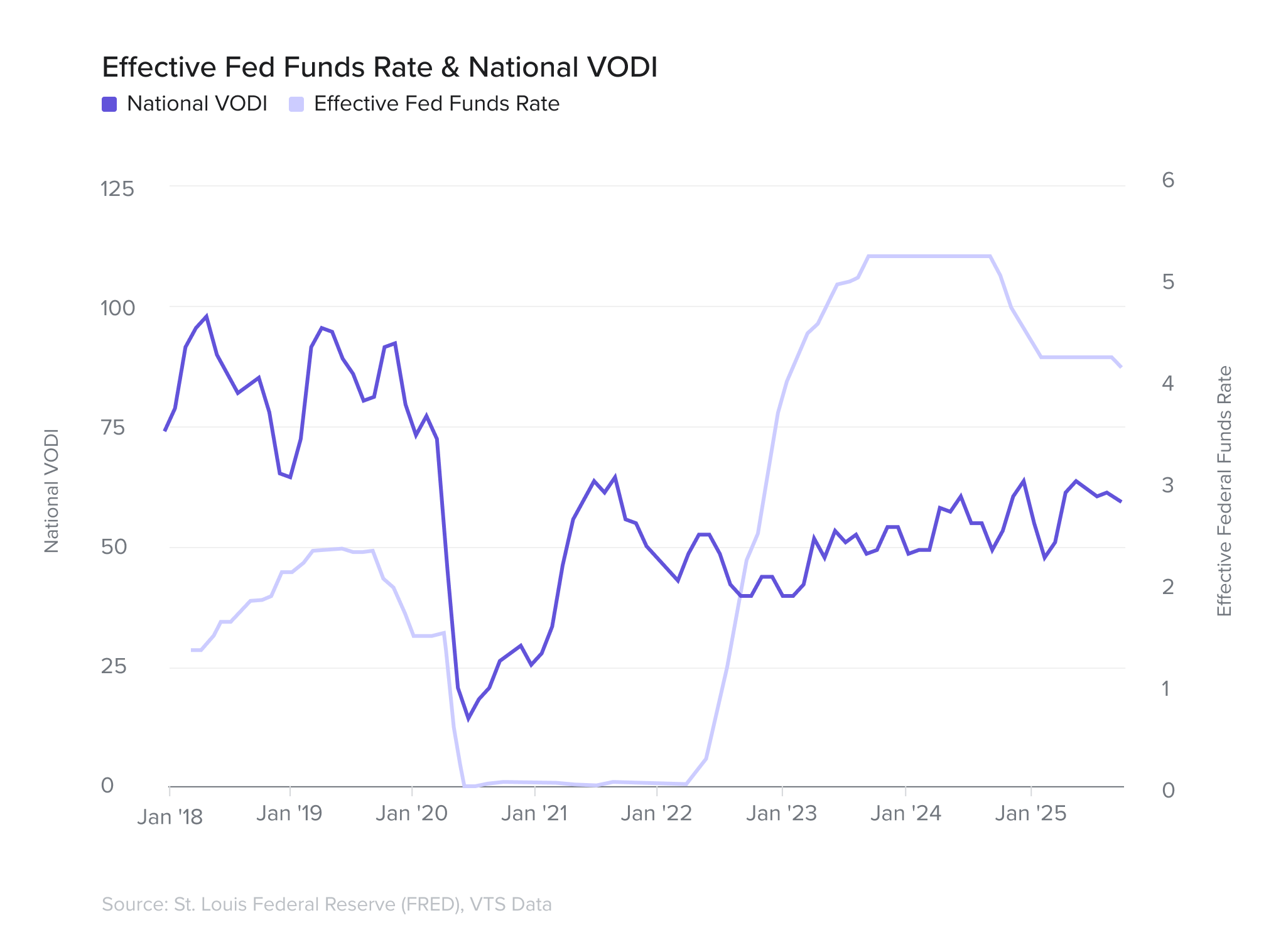

PREVIOUS

The 2025 office market experienced a modest year-over-year rise in demand, largely attributed to significant tech demand increases across several markets. Nationally, the VTS Office Demand Index (VODI) ended the year at 66, representing a six percent year-over-year increase. While demand faced seasonal and cyclical headwinds in the final quarter, declining eight percent versus Q3, the 12-month trajectory was one of progress, with demand consistently flowing in at roughly two-thirds of its pre-pandemic pace. This annual growth was fundamentally driven by the national tech sector, which had a remarkable 87 percent year-over-year surge in requirement demand.

April 2025

This growth comes despite a complex interplay of a cooling labor market, continued shift in work models, and late-year monetary policy changes. The Federal Reserve's late-year rate cuts seek to support a labor market where the unemployment rate hit 4.4 percent by year-end and office-using employment was down from the previous year. However, in tech-centric markets, a decline in telework and rise of the AI sector provided critical tailwinds for physical office demand, as tech companies benefitting from the AI boom experienced rapid growth.

Read more

Read more

Read more

Read more

Read more

Pre-Pandemic

The Reset

The Crash

The Recovery

The Trough

New demand for office space �over the pandemic: An illustration

Is demand �finally thawing?

From January 2018 to March 2020, new office demand fluctuated around a level of 100. In some cities, there was a noticeable downward trend in advance of the pandemic: Chicago, Los Angeles, Seattle; in the other cities the VODI was more ambiguous as to whether it was flat or slightly upward trending.

Pre-Pandemic

In Spring 2020 new office demand fell sharply to the “pandemic low.” Nationally, the VODI fell from 84 in March 2020 to 12 in June 2020, a decline of 86 percent. In some cities the sharp fall was followed by a quick v-shaped rise (New York City and Los Angeles); In others, there was a prolonged u-shaped trough (Washington, San Francisco, Boston, Chicago, and Seattle).

The Crash

From June 2020 through the end of that year, new office demand generally remained very low. In some cities, such as Boston, Chicago and Washington, D.C., the VODI remained more or less flat during this period. In others, such as San Francisco and Seattle, and most notably in New York City and Chicago, this period saw new office demand begin to recover, foreshadowing the phase that was to follow.

The Trough

After vaccines were introduced in early 2021 a sense of return-to-normalcy pervaded. Nationally, the VODI rose from 33 in January 2021 to 85 in June 2021, as demand that had been waiting on the sidelines during The Trough entered the market all at once in a short period. Once that pent-up demand was spent, the VODI quickly subsided.

The Reset

After October 2021, the VODI seemed almost stagnant. It eventually bottomed out at the end of 2022 and has been gradually recovering since then.

The Recovery

Remote work declined modestly in 2025 as return-to-office mandates continued to expand. The percentage of workers who teleworked fell marginally to 22.4 percent, down from 22.8 percent in the previous year. Additionally, the percent of working days done at home hit a post-pandemic low of 27 percent, marking another consecutive year of declines. This signals that while remote work levels still have some staying power relative to before the pandemic, the demand from more employers to have in-office work continues to increase steadily.

�

Learn more about VTS Data

See VODI Methodology

Explore nationwide trends

The national VODI closed the year 16.4 percent higher than a year ago and 39.1 percent higher than two years ago.

At this pace of growth, it would take approximately four more years for the VODI to reach a level of 100 in December.

•

��•

Read more

Pre-Pandemic

Read more

The Crash

Read more

The Trough

Read more

The Reset

Read more

The Thawing

Could we be at

inflection point?

Jan '18

Mar '20

Jun '20

Oct '21

Jan '23

Jan '21

Mar '25

New demand for office space over the pandemic: An illustration

From January 2018 to March 2020, new office demand fluctuated around a level of 100. In some cities, there was a noticeable downward trend in advance of the pandemic: Chicago, Los Angeles, Seattle; in the other cities the VODI was more ambiguous as to whether it was flat or slightly upward trending.

Pre-Pandemic

In Spring 2020 new office demand fell sharply to the “pandemic low.” Nationally, the VODI fell from 84 in March 2020 to 12 in June 2020, a decline of 86 percent. In some cities the sharp fall was followed by a quick v-shaped rise (New York City and Los Angeles); In others, there was a prolonged u-shaped trough (Washington, San Francisco, Boston, Chicago, and Seattle).

The Crash

From June 2020 through the end of that year, new office demand generally remained very low. In some cities, such as Boston, Chicago, and Washington, D.C., the VODI remained more or less flat during this period. In others, such as San Francisco and Seattle, and most notably in New York City and Chicago, this period saw new office demand begin to recover, foreshadowing the phase that was to follow.

The Trough

After vaccines were introduced in early 2021 a sense of return-to-normalcy pervaded. Nationally, the VODI rose from 33 in January 2021 to 85 in June 2021, as demand that had been waiting on the sidelines during The Trough entered the market all at once in a short period. Once that pent-up demand was spent, the VODI quickly subsided from 87 in August 2021 to 61 in October 2021. Although cities whose economies are more remote work-friendly exhibited substantially lower levels of new office demand, all cities experienced a reset.

The Reset

Since October 2021 the VODI has been seemingly stagnant. It trended downward slightly in the earlier part of the period, and bottomed out in late-2022 and early-2023. Since then, it has slowly begun gaining new momentum.

The Thawing

In addition, recent gyrations in new U.S. trade policy have heightened economic uncertainty. Uncertainty typically prompts caution, leading employers to delay hiring and related commitments, such as signing new office leases.

While a cooling labor market normally weakens office demand, the current situation is more complex. We’re still in the midst of a broad return-to-office trend following the COVID-19 pandemic. As the labor market cools, employers gain bargaining power, enabling them to push for more on-site work, which helps offset the drag on office demand.

The sectoral mix of new office demand highlights this offsetting effect. The FIRE sector’s share of new office demand dropped sharply in Q1, falling from 31.9 percent of square footage in November 2024 to just 20.8 percent in March 2025. This sector tends to be more sensitive to shifts in financial conditions and was already among the most advanced in returning to the office, leaving less room for further on-site gains to counterbalance labor market weakness.

Explore nationwide trends

Read VODI impacts on local markets

See VODI Methodology

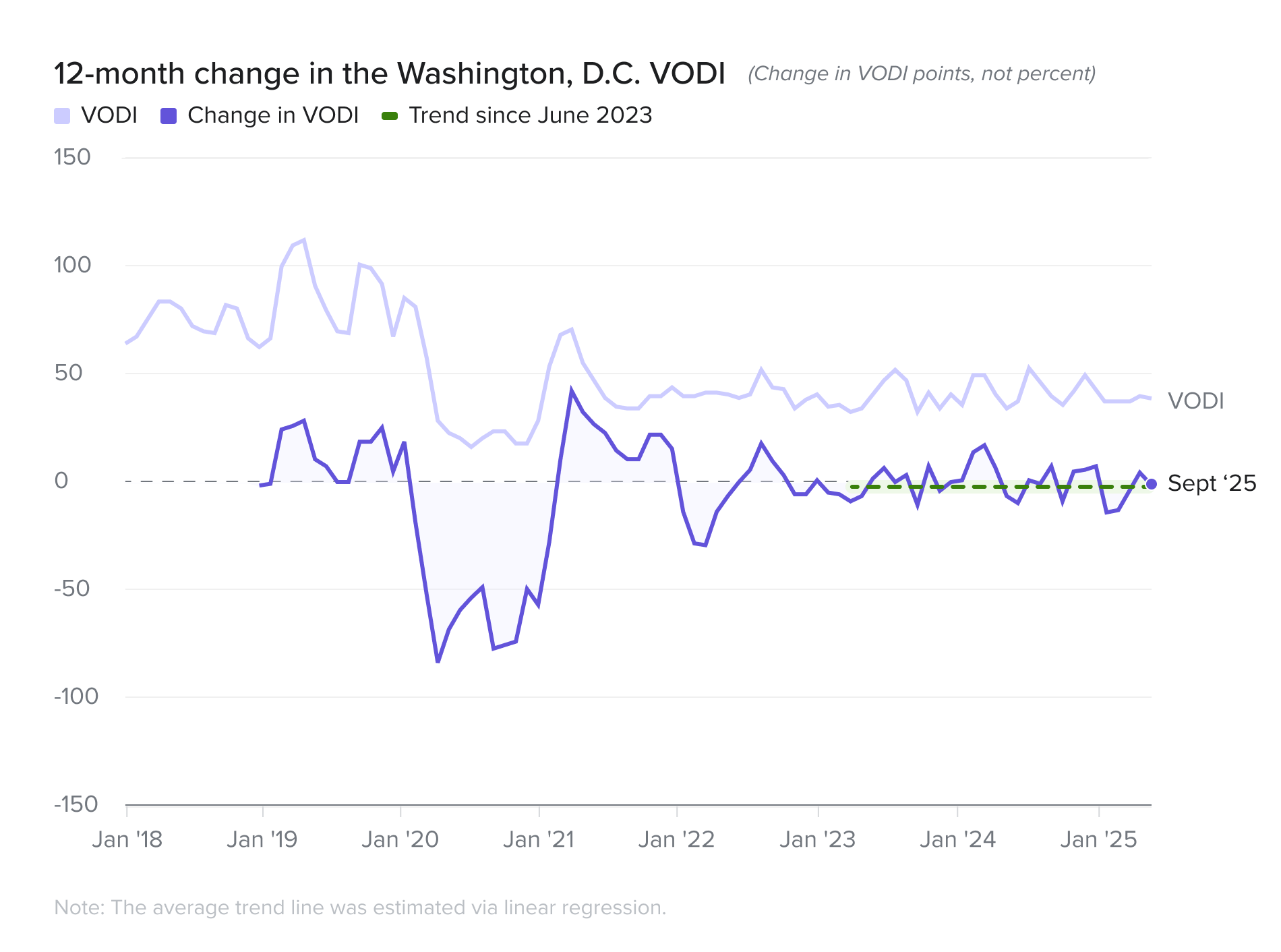

WASHINGTON, D.C.

National

NEXT

Traditional centers:�New York, Chicago, and Washington, D.C.

Markets in Focus

New York finished the year with a VODI of 77, holding flat for the quarter but down 15 percent year-over-year. Large double digit gains materialized in the tech and legal sectors during the year, as it was unable to fully overcome a significant annual decline in demand from its traditional finance industry.

12 month change in VODI

PREVIOUS

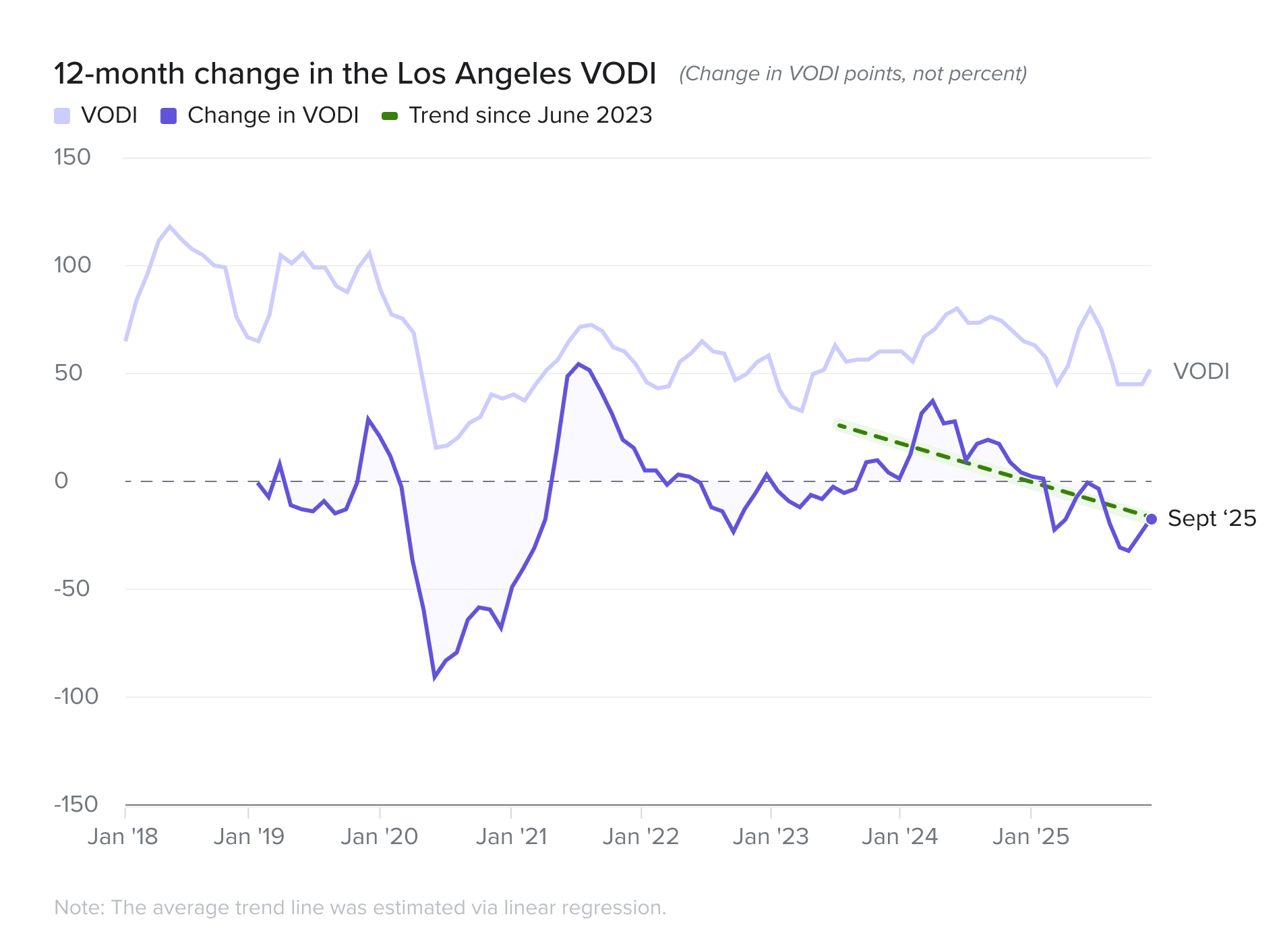

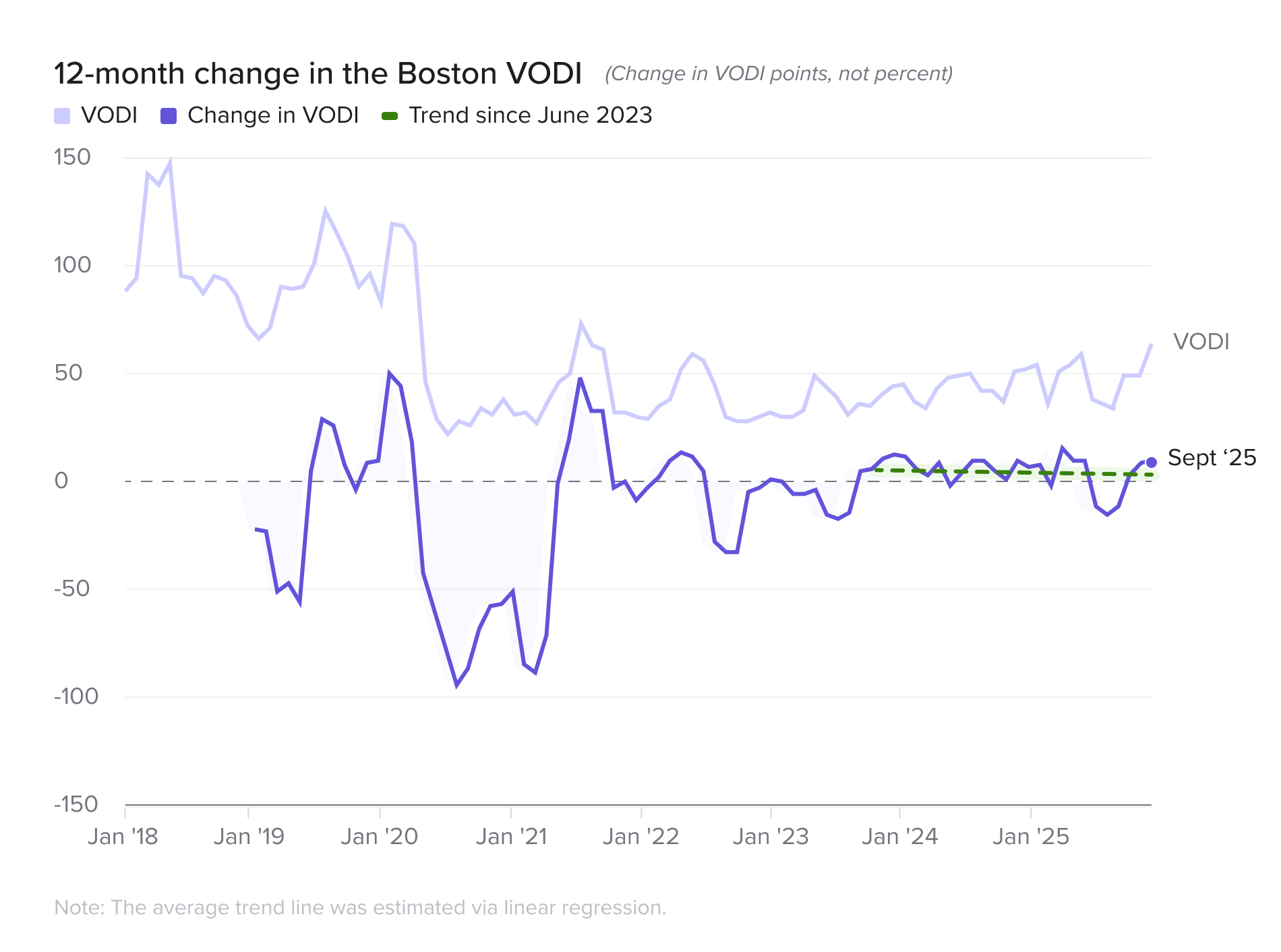

The Rest: Boston and Los Angeles both improved year-over-year, but neither rode the tech wave. Boston's gains came from professional services and creative (an unusual bright spot), while Los Angeles leaned on healthcare and legal. LA's creative sector, in contrast, remains depressed and continues to cap the market's upside.

NEXT

Boston

Chicago

Los Angeles

New York

San Francisco

Seattle

Washington, D.C.

BOOK A DEMO

NEXT

PREV

PREV

The VTS Office Demand Index (VODI) report is a free public-facing analysis based on VTS Data from the previous quarter, capturing office demand in the nation's seven gateway markets. Our VTS Data product includes comprehensive in-depth analytics of numerous benchmarks in over 30 markets across the U.S., the U.K., and Canada. For more information on what VTS Data can provide you, please connect with our team below.

BOOK A DEMO

NEXT

NEXT

PREV

The "push and pull" between employers and employees over remote work saw a surprising slight reversal in the second quarter. After a three year decline, the share of job searches for remote work increased from 6.7 percent to 7.8 percent during the second quarter - the third highest quarterly increase - only behind the increases in Q3 2021 and Q1 2020. This implies employer leverage in the push for a return-to-office is more nuanced and less linear than is commonly thought.

Lastly, Boston’s VODI fell 25.0 percent from its June 2024 level, but the quarterly picture is even more stark, with demand plummeting 45.9 percent.

Boston reversed course in Q2. After multiple quarters over the past year of new demand totaling 2M square feet or more, large tenants disappeared from the market and Boston had its worst quarter for demand in the post-pandemic period.

Headline office demand growth was stable in Q2 2025, masking underlying volatility across markets. The National VTS Office Demand Index (VODI) ended June at a level of 70, 11.1 percent higher than the VODI of 63 recorded in June 2024. The index was flat quarter-over-quarter, down 1.4 percent from 71 in March 2025, as uncertainty abounded from a changing landscape in global trade policy, geopolitical escalations, and as office-using firms try to establish the short- and long-term impacts of AI on productivity and the workforce.

The national VTS Office Demand Index (VODI) finished 2025 at 66. An eight percent decline from Q3 2025, but still growing six percent year-over-year. All despite a decline in office-using employment since the same time last year. This quarterly cooling coincides with a labor market that was already moderating with the unemployment rate at 4.4 percent, up 30 basis points from December 2024. While a cooling labor market typically reduces office demand, it simultaneously increases employer bargaining power with remote work, allowing firms to mandate more on-site work to offset the drag on demand.

�

NATIONAL VODI RESULTS

LA finished the year with a VODI of 63, a modest 11 percent quarterly improvement and a 9 percent annual increase. While a late-year uptick in demand came from the legal and healthcare sectors, its annual performance remained hindered by a creative sector that has yet to recover the levels of demand it was seeing immediately after the pandemic.

increase quarter-over-quarter

11%

los angeles

Still lagging behind: �Los Angeles

�

Markets in Focus

The nation’s capital ended 2025 with some momentum, finishing at a VODI of 65, rounding out with a 35 percent gain from last quarter and 33 percent gain from Q4 2024. DC shrugged off any shutdown uncertainty as large tenant demand returned to the market with legal demand continuing to be a bellwether and with tech also seeing solid annual gains. This market will be one to watch if these gains sustain and federal RTO mandates help push demand levels even higher.

increase quarter-over-quarter

35%

washington, d.c.

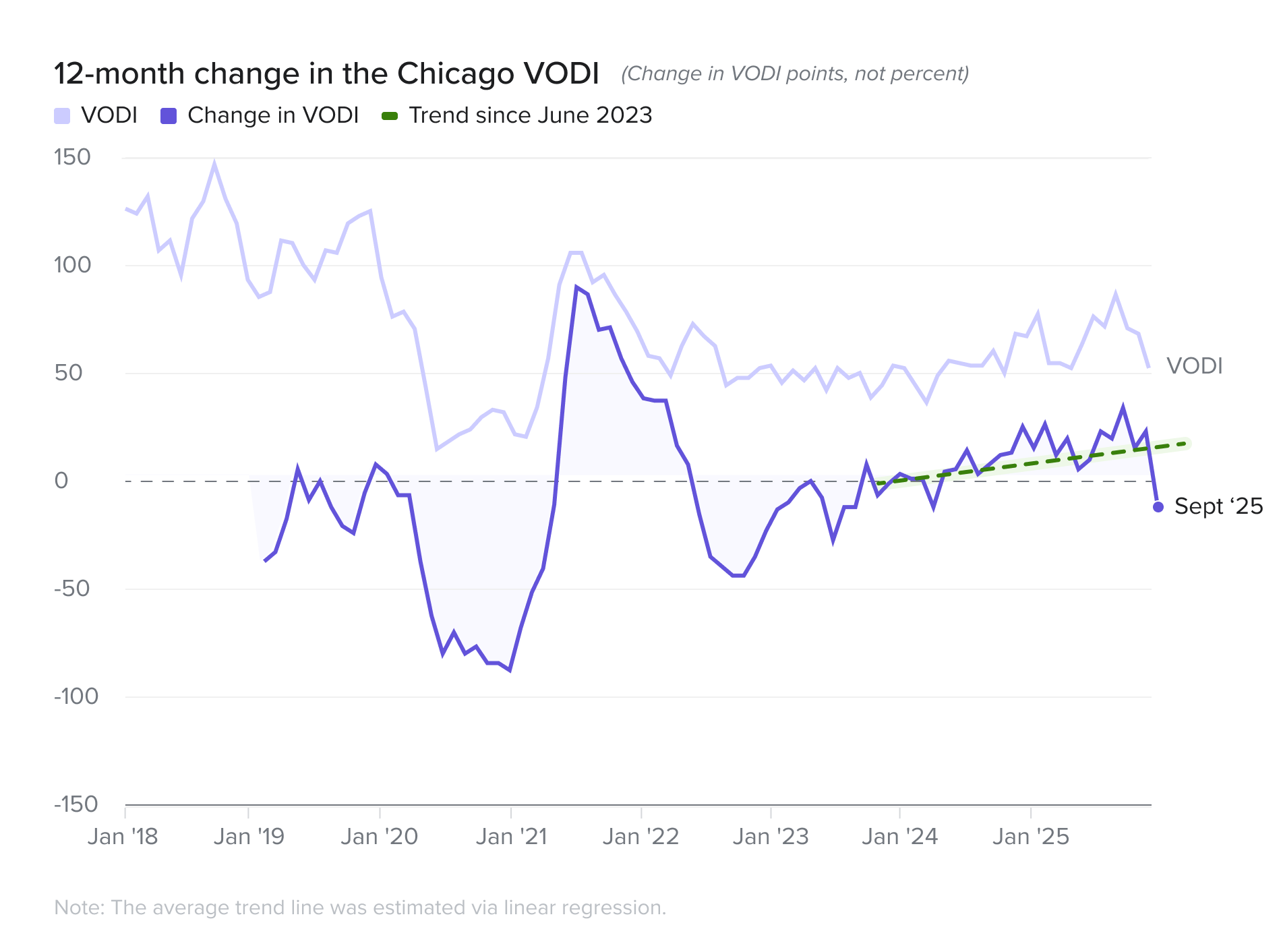

Chicago was the nation's standout in the fourth quarter, finishing with a VODI of 66 and a 50 percent quarterly surge and 43 percent increase from last year. This rebound was driven by an increase in demand for large-block office space, which recovered significantly from the collapse seen mid-year. These gains were supported by legal but driven in large part by none other than the tech sector.

increase quarter-over-quarter

50%

chicago

decline year-over-year

15%

new york

Read VODI impacts on local markets

The fourth quarter of 2025 was defined by a reordering of local market performance. National averages mask a series of intensely local and disparate stories. The following table summarizes the headline performance of the seven major U.S. office markets tracked by the VODI.

A great divergence in market fortunes

local VODI RESULTS

LOCAL

Markets in Focus

Annual demand gains on the back of a quarterly deceleration

NATIONAL VODI RESULTS

The market is currently caught between two recent powerful and opposing macroeconomic forces. The federal government shutdown, effective October 1, presents a significant headwind, immediately halting new federal leasing and imposing an "uncertainty tax" on the private sector that discourages long-term commitments. In direct contrast, the U.S. Federal Reserve's 25 basis point interest rate cut acts as a potential tailwind by reducing borrowing costs for working capital as firms ponder expanding. However, this stimulus is a double-edged sword, as rate cuts also signal the central bank's concern about underlying economic health, the ultimate driver of tenant demand. Notwithstanding, there is still an ongoing trade war which has negatively impacted business and consumer confidence. The market's trajectory will be defined by the tension between the shutdown's cooling effect on confidence and the rate cut's stimulus to capital markets.

San Francisco continues to rapidly recover, with its VODI surging 60 percent quarter-over-quarter to 123, a 112 percent year-over-year gain that cements its status as the nation's top performing market this quarter. The AI-driven boom has accelerated, overwhelmingly powered by large tenants leading a national tech renaissance. Demand from this segment skyrocketed by triple digits in a single quarter.

increase year-over-year

60%

San Franscisco

Executing the quarter's most dramatic turnaround after a dismal second quarter, Boston's VODI soared 85 percent quarter-over-quarter to 63, a 19 percent year-over-year gain. The recovery was driven by the return of large tenants, with demand from this block increasing by 528 percent quarter-over-quarter. This resurgence, powered by the city's core Tech and Legal industries, reflects a broader national trend of large occupiers strategically consolidating into a few select markets.

increase quarter-over-quarter

85%

boston

San Franscisco

Executing the quarter's most dramatic turnaround after a dismal second quarter, Boston's VODI soared 85 percent quarter-over-quarter to 63, a 19 percent year-over-year gain. The recovery was driven by the return of large tenants, with demand from this block increasing by 528 percent quarter-over-quarter. This resurgence, powered by the city's core Tech and Legal industries, reflects a broader national trend of large occupiers strategically consolidating into a few select markets.

increase quarter-over-quarter

85%

boston

Markets in Focus

The tech-driven powerhouses:�San Francisco, Boston, and Seattle

�

�

San Francisco continues to rapidly recover, with its VODI surging 60 percent quarter-over-quarter to 123, a 112 percent year-over-year gain that cements its status as the nation's top performing market this quarter. The AI-driven boom has accelerated, overwhelmingly powered by large tenants leading a national tech renaissance. Demand from this segment skyrocketed by triple digits in a single quarter.

increase year-over-year

60%

chicago

Markets in Focus

The quarterly correction: �Chicago and New York City

�

After a standout previous quarter, Chicago's VODI collapsed by 40 percent quarter-over-quarter to 45, erasing all recent gains and leaving it down 25 percent year-over-year. The drivers of the prior surge vanished as large tenant demand evaporated - falling by 66 percent. The decline was broad and severe, impacting key sectors like Creative, Legal, and Tech, highlighting the fragility of markets lacking a dominant, secular growth driver.

decline quarter-over-quarter

40%

Boston

Chicago

Los Angeles

New York

San Francisco

Seattle

Washington, D.C.

12 month change in VODI

NATIONAL

The market is currently caught between two recent powerful and opposing macroeconomic forces. The federal government shutdown, effective October 1, presents a significant headwind, immediately halting new federal leasing and imposing an "uncertainty tax" on the private sector that discourages long-term commitments. In direct contrast, the U.S. Federal Reserve's 25 basis point interest rate cut acts as a potential tailwind by reducing borrowing costs for working capital as firms ponder expanding. However, this stimulus is a double-edged sword, as rate cuts also signal the central bank's concern about underlying economic health, the ultimate driver of tenant demand. Notwithstanding, there is still an ongoing trade war which has negatively impacted business and consumer confidence. The market's trajectory will be defined by the tension between the shutdown's cooling effect on confidence and the rate cut's stimulus to capital markets.

Annual demand gains on the back of a quarterly deceleration

NATIONAL VODI RESULTS

Read VODI impacts on local markets

The market is currently caught between two recent powerful and opposing macroeconomic forces. The federal government shutdown, effective October 1, presents a significant headwind, immediately halting new federal leasing and imposing an "uncertainty tax" on the private sector that discourages long-term commitments. In direct contrast, the U.S. Federal Reserve's 25 basis point interest rate cut acts as a potential tailwind by reducing borrowing costs for working capital as firms ponder expanding. However, this stimulus is a double-edged sword, as rate cuts also signal the central bank's concern about underlying economic health, the ultimate driver of tenant demand. Notwithstanding, there is still an ongoing trade war which has negatively impacted business and consumer confidence. The market's trajectory will be defined by the tension between the shutdown's cooling effect on confidence and the rate cut's stimulus to capital markets.

quarterly gain

2%

Washington, D.c.

Washington, D.C.'s VODI posted a modest 2 percent quarterly gain to 49. However, this masks a concerning trend. The market's core demand drivers, Association/Nonprofit and Government, declined by 34 percent and 9 percent quarter-over-quarter, respectively. The market was held in positive territory only by cyclical gains from the Finance and Legal sectors. This means Washington, D.C. entered the federal government shutdown with its primary, most stable demand drivers already in retreat, making it uniquely vulnerable to a prolonged impasse.

Deceptive stability on the eve of the shutdown: Washington, D.C.

Markets in Focus

increase year-over-year

60.4%

Chicago AND San Franscisco

Chicago's VODI rocketed up 60.4 percent year-over-year and an impressive 35.1 percent since March led by the legal and finance sectors.

San Francisco also showed strong momentum, with its VODI rising 27.3 percent year-over-year and surging 40 percent since the end of Q1, fueled by a rebound in tech demand that continues to be led by the push in AI.

increase year-over-year

60%

San Franscisco

San Francisco continues to rapidly recover, with its VODI surging 60 percent quarter-over-quarter to 123, a 112 percent year-over-year gain that cements its status as the nation's top performing market this quarter. The AI-driven boom has accelerated, overwhelmingly powered by large tenants leading a national tech renaissance. Demand from this segment skyrocketed by triple digits in a single quarter.

increase quarter-over-quarter

85%

boston

Executing the quarter's most dramatic turnaround after a dismal second quarter, Boston's VODI soared 85 percent quarter-over-quarter to 63, a 19 percent year-over-year gain. The recovery was driven by the return of large tenants, with demand from this block increasing by 528 percent quarter-over-quarter. This resurgence, powered by the city's core Tech and Legal industries, reflects a broader national trend of large occupiers strategically consolidating into a few select markets.

The surging markets�

Markets in Focus

decline quarter-over-quarter

40%

chicago

After a standout previous quarter, Chicago's VODI collapsed by 40 percent quarter-over-quarter to 45, erasing all recent gains and leaving it down 25 percent year-over-year. The drivers of the prior surge vanished as large tenant demand evaporated - falling by 66 percent. The decline was broad and severe, impacting key sectors like Creative, Legal, and Tech, highlighting the fragility of markets lacking a dominant, secular growth driver.

Washington, D.C.

Seattle

San Francisco

New York

Los Angeles

Boston

Boston

Chicago

Los Angeles

New York

San Francisco

Seattle

Washington, D.C.

decline quarter-over-quarter

40%

chicago

After a standout previous quarter, Chicago's VODI collapsed by 40 percent quarter-over-quarter to 45, erasing all recent gains and leaving it down 25 percent year-over-year. The drivers of the prior surge vanished as large tenant demand evaporated - falling by 66 percent. The decline was broad and severe, impacting key sectors like Creative, Legal, and Tech, highlighting the fragility of markets lacking a dominant, secular growth driver.

The quarterly correction: �Chicago and New York City

Markets in Focus

Tech demand defined the year. The technology sector was the dominant force driving demand in 2025, primarily due to the accelerated adoption of AI. Tech sector demand increased by a substantial 87 percent in 2025 compared to 2024, far surpassing all other industry segments. Five of the seven major markets saw annual tech demand grow more than 50 percent year-over-year.

In contrast, the legal sector, traditionally a significant driver of office demand, held a distant second place. The gap between tech and legal highlights the AI-fueled market activity that defined the 2025 economic landscape. Growth in the tech sector will be something to closely monitor in 2026 for durability as office demand faces multiple crosscurrents working for and against it.

�

�

Remote work hits post-pandemic low

Technology leads office demand growth

The year also concluded with a definitive shift in the Federal Reserve's stance, but lower rates have not prevented unemployment from rising, which is now up 30 basis points since December of last year. Additionally, office-using job growth was negative over the trailing 12 months. The softer job market will give employers more leverage to continue to push more RTO which will help cushion any drag on demand from the slower pace of hiring.

�

Cooling job growth reinforces employer control

Ending the year at a VODI of 48, Seattle recorded a 27 percent quarterly decline. Despite the late-year slowdown, annual tech demand in Seattle remained much stronger than in the previous year. However, Seattle continues to struggle as demand increasingly shifts toward its suburban Metroeast counterpart.

quarterly decline

27%

Seattle

Boston finished 2025 at a VODI of 38, the lowest amongst the top markets nationally. Although the VODI grew 15 percent in Q4 from the same time last year, demand from its core sectors like finance and legal lagged 2024 figures and were down double digits. Demand was supported primarily by the growth from professional services and the creative sector, not traditionally a Boston strength.

increase year-over-year

15%

boston

The market ended the year at a VODI of 68. While this was a sharp 46 percent correction from its Q3 peak, the city remains a standout for annual growth, with overall demand finishing significantly higher than it began the year. Demand from large tenants, which skyrocketed earlier in the year due to AI, slowed noticeably in the final quarter.

percent correction from its Q3 peak

46%

SAN FRANCISCO

The tech-driven powerhouses:�San Francisco, Boston, and Seattle

Markets in Focus

Remote work declined modestly in 2025 as return-to-office mandates continued to expand. The percentage of workers who teleworked fell marginally to 22.4 percent, down from 22.8 percent in the previous year. Additionally, the percent of working days done at home hit a post-pandemic low of 27 percent, marking another consecutive year of declines. This signals that while remote work levels still have some staying power relative to before the pandemic, the demand from more employers to have in-office work continues to increase steadily.

Remote work declined modestly in 2025 as return-to-office mandates continued to expand. The percentage of workers who teleworked fell marginally to 22.4 percent, down from 22.8 percent in the previous year. Additionally, the percent of working days done at home hit a post-pandemic low of 27 percent, marking another consecutive year of declines. This signals that while remote work levels still have some staying power relative to before the pandemic, the demand from more employers to have in-office work continues to increase steadily.

Remote work hits post-pandemic low

Tech demand defined the year. The technology sector was the dominant force driving demand in 2025, primarily due to the accelerated adoption of AI. Tech sector demand increased by a substantial 87 percent in 2025 compared to 2024, far surpassing all other industry segments. Five of the seven major markets saw annual tech demand grow more than 50 percent year-over-year.

In contrast, the legal sector, traditionally a significant driver of office demand, held a distant second place. The gap between tech and legal highlights the AI-fueled market activity that defined the 2025 economic landscape. Growth in the tech sector will be something to closely monitor in 2026 for durability as office demand faces multiple crosscurrents working for and against i�

�

Chicago was the nation's standout in the fourth quarter, finishing with a VODI of 66 and a 50 percent quarterly surge and 43 percent increase from last year. This rebound was driven by an increase in demand for large-block office space, which recovered significantly from the collapse seen mid-year. These gains were supported by legal but driven in large part by none other than the tech sector.

increase quarter-over-quarter

50%

New york city

Remote work declined modestly in 2025 as return-to-office mandates continued to expand. The percentage of workers who teleworked fell marginally to 22.4 percent, down from 22.8 percent in the previous year. Additionally, the percent of working days done at home hit a post-pandemic low of 27 percent, marking another consecutive year of declines. This signals that while remote work levels still have some staying power relative to before the pandemic, the demand from more employers to have in-office work continues to increase steadily.

The year also concluded with a definitive shift in the Federal Reserve's stance, but lower rates have not prevented unemployment from rising, which is now up 30 basis points since December of last year. Additionally, office-using job growth was negative over the trailing 12 months. The softer job market will give employers more leverage to continue to push more RTO which will help cushion any drag on demand from the slower pace of hiring.

decline quarter-over-quarter

35%

New york city

New demand contracted sharply in the nation's largest office market, with its VODI falling 24 percent quarter-over-quarter to 78. Weakness was concentrated in its traditional power centers, with demand from the Finance and Legal sectors falling double digits. Despite solid gains from Flex Space providers and Association/Non-Profits, these increases were not enough to offset the decline in its power industries.

Read more

Pre-Pandemic

Read more

The Crash

Read more

The Trough

Read more

The Reset

Read more

The Recovery

New demand for office space over the pandemic: An illustration

From January 2018 to March 2020, new office demand fluctuated around a level of 100. In some cities, there was a noticeable downward trend in advance of the pandemic: Chicago, Los Angeles, Seattle; in the other cities the VODI was more ambiguous as to whether it was flat or slightly upward trending.

Pre-Pandemic

In Spring 2020 new office demand fell sharply to the “pandemic low.” Nationally, the VODI fell from 84 in March 2020 to 12 in June 2020, a decline of 86 percent. In some cities the sharp fall was followed by a quick v-shaped rise (New York City and Los Angeles); In others, there was a prolonged u-shaped trough (Washington, San Francisco, Boston, Chicago, and Seattle).

The Crash

From June 2020 through the end of that year, new office demand generally remained very low. In some cities, such as Boston, Chicago, and Washington, D.C., the VODI remained more or less flat during this period. In others, such as San Francisco and Seattle, and most notably in New York City and Chicago, this period saw new office demand begin to recover, foreshadowing the phase that was to follow.

The Trough

After vaccines were introduced in early 2021 a sense of return-to-normalcy pervaded. Nationally, the VODI rose from 33 in January 2021 to 85 in June 2021, as demand that had been waiting on the sidelines during The Trough entered the market all at once in a short period. Once that pent-up demand was spent, the VODI quickly subsided.

The Reset

After October 2021, the VODI seemed almost stagnant. It eventually bottomed out at the end of 2022 and has been gradually recovering since then.

The Recovery

Jan '18

Mar '20

Jun '20

Oct '21

Jan '23

Jan '21

Dec '25